For sales transactions to be included in VAT accounts, in VAT-7 tax returns and in SAF-T file, it is currently necessary to include a receipt or receipt correction in a statement of retail sale (SRS) or in its correction (CRS). The same rules apply also in the case of receipts and receipt corrections to which a VAT sales invoice or VAT sales invoice correction has been issued. Such sales invoice generated from a receipt is no longer presented in VAT accounts so as not to duplicate the sales value.

Due to changed regulations of Article 109.3 of the Act of May 13th, 2016 regarding the changed act – Tax Law as well as some other acts (Journal of Laws of 2016, item 846), as of 2017.1 version of the system, in a database generated in Polish language version, it is possible to include in VAT accounts also sales invoices generated to receipts. To enable such an option, from the level of System -> Configuration -> Accounting, it is necessary to check parameter Generate VAT invoices in VAT account to invoices issued from receipts which is unchecked by default. It determines whether at the moment of confirming an invoice (or its corrections) generated to a receipt, a VAT invoice (or VAT invoice correction) should be created in a VAT sales account.

After selecting the parameter Generate VAT invoices in VAT account to invoices issued from receipts in definition of documents: SI/SIQC/SIVC, a user can specify a VAT account in which VAT invoice must be registered. A suggested option is Default, which can be changed to other VAT accounts available in a given center. If given VAT account is detached from a given center, then a default VAT account will be set in document definition.

In VAT invoices generated to invoices issued from receipts, setting of VAT-7 parameter depends on the pattern type of VAT account. In the case of Suggested pattern type, VAT-7 parameter is set to NO (such invoice will be included neither in VAT tax return nor in SAF-T file) and in the case of Obligatory pattern type, VAT-7 parameter is set according to VAT account parameters.

If a user wants to include an invoice and not a statement of retail sale in VAT-7 tax return and in SAF-T file, VAT7 parameter must be set to YES.

When posting a receipt or an invoice generated to that receipt or a generated VAT invoice, the other documents are also marked as posted.

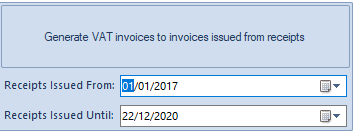

Selecting the parameter Generate VAT invoices in VAT account to invoices issued from receipts and relogging to the program activates a function Generate VAT Invoices To Invoices From Receipts in tab Add-Ons. Using this functionality, it is possible to generate VAT invoices for a selected period from 1st of January, 2017. VAT invoices are generated only if none VAT invoice has yet been generated to a given invoice issued from a receipt.