In the Polish version of database, the list of VAT accounts is composed of two tabs: VAT Accounts and VAT-ZD. The VAT-ZD tab is not available in other language versions.

VAT accounts tab

The menu of VAT Accounts tab is composed of the following groups:

- Accounts with buttons: [Add Subaccount], [Add Account], [Edit], [Delete], [Refresh], [Renumber]

- List with buttons: [Add], [Correct], [Change in Single Batch], [Manual Correction], [Refresh], [Edit], [Delete], [Copy]

- Posting with buttons: [Post], [View Unposted Entries], [Post Manually], [View Journal Entry]

- Printouts with buttons: [Print List], [Print Document]

Documents in VAT accounts can be created in two ways:

- Through confirmation of a sales or purchase trade document as well as value or quantity correction of such document – then, VAT invoices are generated automatically based on the source document and are included in the default purchase or sales account.

- By adding a VAT invoice or a VAT invoice correction manually, directly from the level of VAT account.

Organization of documents in a VAT account, in terms of assigning them appropriate ordinal number, is related to parameter VAT accounts numeration available in the system configuration window in tab Accounting. An ordinal number a document receives can be granted within a month (monthly numeration) or within a year (continuous numeration).

Operations which can be performed in the VAT Accounts tab:

- Adding an account – button [Add Account]

- Adding a subaccount – button [Add Subaccount]

- Renumbering VAT incvoices – button [Renumber] The possibility of renumbering the ordinal number (No.) depends on numeration option selected in the system configuration. If yearly numeration of VAT accounts has been selected, the renumbering option is only available in case of setting Date filter in a given VAT account to Year. Then, the renumbering applies to the entire year. If monthly numeration has been selected in the system configuration, the renumbering option is only available in case of setting Date filter to Month. Then, the renumbering applies to the entire month.Renumbering in VAT sales account within a selected accounting period sorts documents in the following order:

- by registration date

- within the same registration date by type of source document (in Polish version of the system: SI, ASI, VSI, SIQC, ASIC, SRS, CRS, VSIC, in other system versions: SI, ASI, R, VSI, SIVC, SIQC, RVC, RQC, VSIC)

- within the same type of documents by particular numerators (according to numerator ID)

- within the same numerator alphabetically by series

- within one series by document number

- Adding correction – button [Manual Correction]

- Copying a VAT invoice – when copying documents in VAT (sales and purchase) accounts, the date of registration is retrieved from account settings, other dates are set according to the current date.

- Adding a correction to an invoice – option [Correct]. Allows for adding a correction to a specific VAT invoice. The data on a correction document is filled in automatically on the basis of document being corrected. Amounts with an opposite sign to amounts of the document being corrected are generated in a correction, by default.

- Editing VAT invoice

- Deleting VAT invoice – option [Delete]. Only unposted/unpaid VAT invoices, added manually to an account, can be deleted.

- Changing in a single batch of an account or/and date of tax point – option [Change]. It allows a batch change on marked VAT invoices – change of an account or date of tax point

- Posting a VAT invoice – button [Post]

- Generating an unposted entry to a VAT invoice – button [View Unposted Entries]

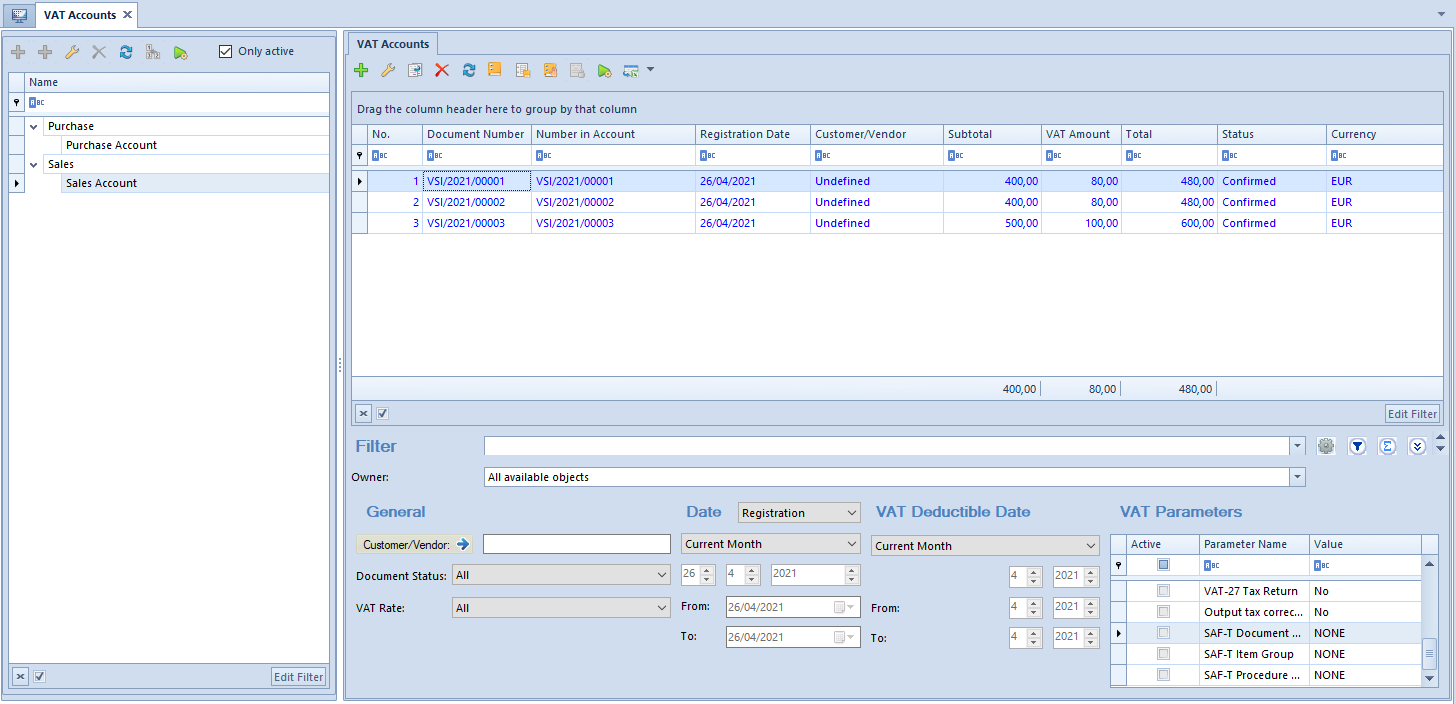

The VAT Accounts tab is divided into the following sections:

- Accounts Tree – presents the structure of sales and purchase accounts and subaccounts

- VAT Invoices – depending on marked account/subaccount, appropriate invoices registered in the selected VAT account are displayed in the list

- Filter panel – allows for filtering list of VAT invoices

VAT accounts tree

VAT accounts structure has a tree layout and is divided into two predefined sections:

- Purchase – contains accounts and subaccounts in which VAT invoices registering a purchase operation are included

- Sales – contains accounts and subaccounts in which VAT invoices registering a sales operation are included

These sections can be neither edited nor deleted. Each account or subaccount defined in the system must be contained in one of them.

On the accounts tree, it is possible to define two types of objects:

- Account – it is the firs level in Purchase or Sales

- Subaccount – it is the second level in Purchase or Sales. Each subaccount must be assigned to an account. A subaccount can be added only if parameter Add subaccounts has been previously checked in the main purchase or sales account. This operation must be performed at the very beginning of work with the system, before the first VAT invoice is added

In databases created in French, there are accounts created automatically in branch Purchase (Purchase Invoices and Expenses) and one account in in branch Sales (Sales Invoices), by default.

In other language versions, there is one purchase and one sales account created, by default.

Next to the quick access buttons, there is the parameter Only active which allows the user to filter the VAT accounts with regard to their activity.

List of VAT invoices

The list of VAT invoices displays all the VAT invoices registered in the selected account available on the accounts tree.

On the list of VAT invoices, it is possible to select additional columns, such as: TIN, Country Prefix or Owner.

Filter panel

Detailed description of functioning of the filters can be found in category Searching and filtering data.

Owner – allows filtering the list of VAT invoices by their owners

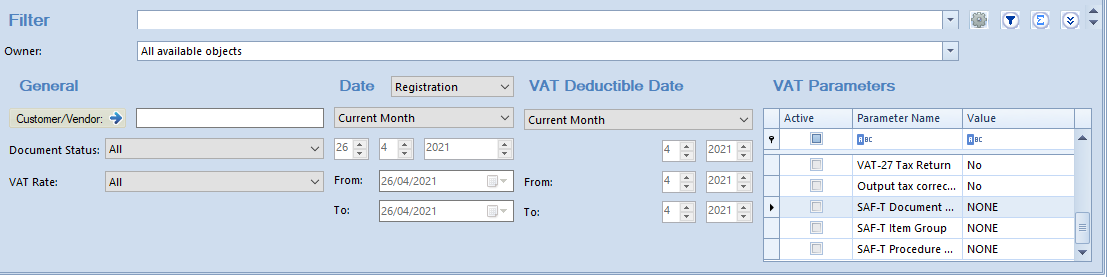

The filtering panel is divided into four basic sections:

General – allows filtering the lis of invoices by:

- Customer/Vendor

- Document Status – (All, Posted/Unposted). In case if statuses Confirmed/Canceled are activated in VAT invoice definitions, there are three additional filtering options available: Canceled, Unconfirmed, Confirmed

- VAT Rate – (it is possible to select a rate from VAT rate group assigned to a company to which a user is logged-in)

Date – allows for filtering the list according to one of the available dates.

For purchase accounts these dates are the following:

- Registration

- Issue

- Receipt

- Purchase

- Vendor’s Tax Point

- Right To Deduct

For sales accounts these dates are the following:

- Registration

- Issue

- Sales

- Tax Point

Time ranges available for selection are the following:

- Current Month

- Day

- Month

- Year

- Range of Dates

- Previous Month

- Any

Other fields are used for specifying of appropriate time ranges for filtering.

VAT Deductible Date – allows for filtering the list according to a time range within which documents were registered in a JPK_V7M file/tax return. Time ranges available for selection are the following:

- Current Month

- Month

- Year

- Previous Month

- Range of Dates

- Any

VAT Parameters – allows for filtering the list by VAT parameters. To filter the list of VAT invoices, the checkbox available in the Active column should be checked by the parameters which must be included in the searched VAT invoices