Contents

General information

VAT sales and purchase invoices are added the same way. Thus, this mechanism is described only once on the basis of a purchase invoice.

To add a VAT purchase invoice, select an account/subaccount in which the invoice will be registered and click [Add] in the List button group. The form of the VAT invoice will then be displayed.

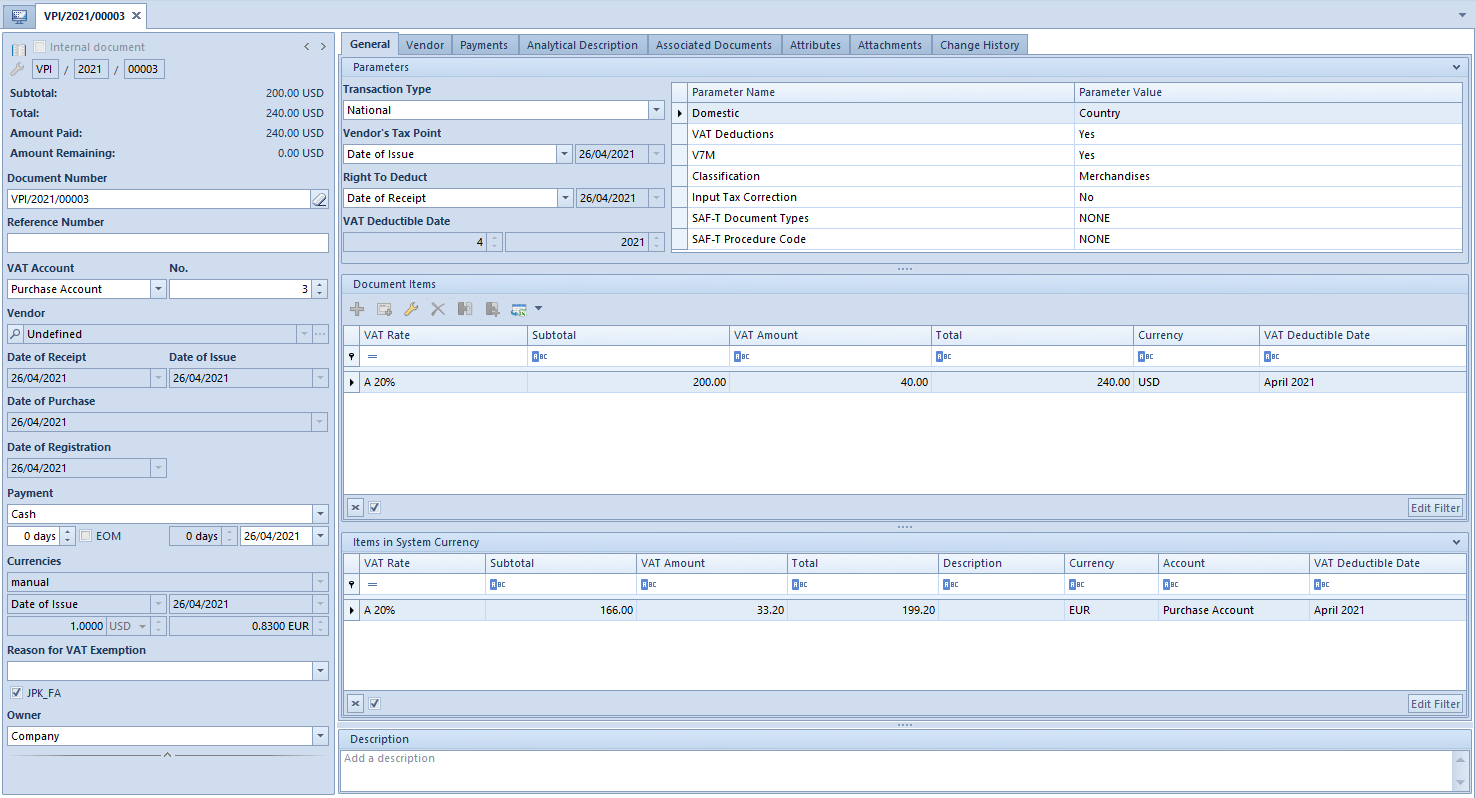

General tab

OCR – symbol of the status of a document added with the use of the OCR service. The symbol is not displayed for documents not added by OCR.

Internal Document – marking of a document as internal document

Number in Account – number granted automatically by the system according to the numerator definition

Netto – wartość netto faktury

Brutto – wartość brutto faktury

Subtotal – invoice subtotal value

Total – invoice total value

Paid – value of the invoice that has been paid

Amount Remaining – value of the invoice that still needs to be paid

Document Number – in documents being registered directly in a VAT account, the option AUTO is displayed by default. A document receives a specific number not until it is saved manually or automatically (for instance, after proceeding to tab Payments).

That number is consistent with number in the account. In VAT purchase documents, it is possible to enter any value into this field by clearing its content with the eraser button. In VAT documents generated automatically to trade documents, field Document Number is filled in with the number of a trade document.

In a database created in French language version, this field is not available in VSI and VPI documents.

Reference Number – in this field it is possible to provide the invoice number under which it was registered in other system

Account – VAT account in which a VAT invoice will be registered

No. – ordinal number assigned automatically by the system

Customer or Vendor – name of an entity the VAT invoice is assigned to

A user may update customer/vendor data, that is: name, TIN, EIN and NIN on a confirmed document (if full diagram of statuses is enabled) by selecting a customer/vendor again, whereas that user must have the permission to update data of a customer/vendor in confirmed documents assigned (Configuration → Company Structure → Operator Groups → tab Other Permissions).

Date of Receipt – document date of receipt; field available only in VAT purchase invoices

Date of Issue – VAT invoice date of issue

Date of Purchase – date of purchase; field available only in VAT purchase invoices

Date of Sale – date of sale; field available only on VAT sales invoices

Registration Date – invoice date of registration in VAT account

The above dates can be used to specify a tax point date, whereby, when fixing a tax point date in reference to registration date, first it is necessary to specify a proper tax point definition in the menu Configuration → Accounting → Tax Point by selecting a value From the registration date in the field Condition. A new tax point definition can be assigned to the definition of selected VAT account and its validity date can be specified. Selected tax point date will automatically be filled in VAT invoices being added to given VAT account. A specified tax point date can also be selected directly in a document.

Payment Form – allows for the selection of payment form for a given document

Due Date – number of days from the date of registration on the basis of which the planned payment date is determined

EOM – due date of End of Month type. Upon checking this parameter, a section for specifying number of days by which a due date will be postponed on the basis of the end of month becomes active

Split Payment – this parameter is available only if in the definition of a center of Company type, for the parameter Handle split payment according to Polish regulations, the value In accounting and trade modules is selected. Checking the parameter Split payment in the VAT invoice header automatically checks the parameter Split payment in all document payments where PLN currency and Bank payment form are selected.

Currencies – a document currency is by default determined on the basis of the currency assigned to a given customer/vendor. In case the currency assigned to a given entity is inactive, the system currency is set in a document. Upon changing a customer/vendor, data in a document is recalculated according to the new currency and a user is notified about it in an appropriate message.

It is possible to select a different currency than the one assigned to a customer/vendor specified in a document.

A currency exchange rate is retrieved on the basis of the settings specified in the definition of given document type (menu Configuration → Company Structure → Rights Structure → edited company form → Documents tab).

Reason for VAT Exemption – if VAT rate of tax-exempt type (D TE) is applied in an invoice, it is then possible to select the reason for VAT exception. Apart from selecting the predefined values, a user may define new values in the dedicated generic directory (menu Configuration → Generic Directories → group General → Reason for VAT Exemption). This field is editable in the invoices registered directly in a VAT account. In VAT invoiced generated from a trade document, value in this field is copied from the trade document. Detailed description of this field can be found in the manual Comarch ERP Standard – Standard audit file.

SAF-T_INV – this parameter is by default selected. It informs to include a VAT invoice being registered directly in a VAT account in a SAF-T_INV file. Detailed description of this parameter can be found in the manual Comarch ERP Standard – Standard audit file.

Owner – a default center to which the user adding a VAT invoice is logged-in

Transaction Type – the type of transaction can be selected from among the following options: National, IntraCommunity, Non-EU. Transaction type filters the list of VAT parameters to those which were previously assigned to it.

VAT Parameters – the parameters panel is divided into two columns:

- Parameter Name – contains the name of VAT parameter

- Parameter Value – contains value assigned to given parameter

VAT parameters are defined from the level of Configuration → Accounting → VAT Parameters Available parameters:

- National – transaction type selected in General tab

- Parameter values: Country, TaxFree (available on sales documents), Customer is a taxpayer (available on sales documents)

- Intra-Community – transaction type selected in General tab

- Parameter values: Intra-community delivery/purchase, Trilateral Intra-community Delivery/Purchase, Delivery Taxed Abroad (available on sales documents), Customer is a taxpayer (available on sales documents)

- Non-EU – transaction type selected in General tab

- Parameter values: Import, Export (available on sales documents), Delivery Taxed Abroad (available on sales documents), Customer is a taxpayer (available on sales documents)

- VAT Deductions – parameter available on purchase documents

- Parameter values: Yes, No, Conditionally

- V7M – value of the parameter indicated if an item is to be included in the JPK_V7M file

- Parameter values: Yes, No

- VAT-27 – parameter available on sales documents with National transaction type. Its value determines whether a document item must or must not be included in a VAT-27 tax return. If a value Customer is a taxpayer is set in the field Domestic, value of the VAT-27 parameter will automatically be set to

- Parameter values: Yes, No

- VAT-EU – parameter available for Intra-community transaction type. Its value determines whether a document item must or must not be included in a VAT- EU tax return.

- Parameter values: Yes, No

- Type – parameter available for sales and purchase documents,

- Parameter values: Merchandises, Services, Costs, Fixed Assets, Means of Transport, Real Estate, Service payable to customer, Purchase of cash registers, Physical inventory

- Input Tax Correction – parameter available on purchase documents

- Parameter values: Yes, No, Article 89b. 1 of the Act, Article 89b. 4 of the Act

- Type – parameter available for sales and purchase documents. Parameter values:

- CRT – internal collective document containing information about sales from cash registers. The value is available on sales documents only and it is set by default for invoices generated during the confirmation of CRS and SRS documents.

- INT – internal document. By default, the value is set for VAT invoices with checked parameter Internal document.

- RI – invoice referred to in art. 109 sec. 3d of the Act. The value is available on sales documents only and it is set by default for invoices with checked parameter Invoice to Receipt.

- CB – invoice issued by a taxpayer being vendor or service provider, who has selected liquidation cash method defined in art. 21 of the Act. The value is available on purchase documents only.

- VAT_FRF – VAT FRF invoice referred to in art. 116 of the Act. The value is available on purchase documents only.

- NONE – document different than CRT, INT, RI, CB, VAT_FRF. By default, the value is set for the other types of documents.

- SAF-T Item Group – parameter available in the header of sales and purchase documents only. It can assume several values. When generating VAT invoice from a trade document, the value of the parameter is transferred from the generic directory SAF-T Procedure Code value indicated on trade document items.

- Parameter values: NONE, GSG_01 Alcoholic beverages, GSG_02 Goods mentioned in art. 103 sec. 5a of the Act, GSG_03 Heating oil, GSG_04 Tobacco products, GSG_05 Waste specified in items 79-91 of Appendix no. 15 to the Act, GSG_06 Electronic devices, GSG_07 Vehicles and automotive parts, GSG_08 Noble and non-noble metals, GSG_09 Medicines and medical devices, GSG_10 Buildings, structures and lands, GSG_11 Services for the transfer of permits for greenhouse gas emissions, GSG_12 Intangible services (consulting, accounting, etc.), GSG_13 Transport and warehouse management services.

- SAF-T Procedure Code – parameter available in the header of sales and purchase documents only. It can assume several values. The value of the parameter is transferred from the generic directory SAF-T Procedure Code value indicated on customer form. Additionally, when generating VAT invoice from a trade document, the value of the parameter is transferred from the generic directory SAF-T Procedure Code value indicated on trade document items.

- Parameter values: NONE, MOS Mail order sales, EE Telecommunications, broadcasting, and electronic services, AF Affiliations between a customer vendor, TT_IC Second taxpayer, TT_S Second taxpayer, MR_T Tourism margin, MR_SH Second-hand goods, works of art, antiques, I_42 ICS Custom procedure 42 (import), I_63 ICS Custom procedure 63 (import), V_SPV Transfer of a single-purpose voucher art. 8a.1, V_SPV_SUPPLY Supplies related to a single-purpose voucher, V_MPV_Supply Supplies related to the transfer of a multi-purpose voucher, SPM Split payment mechanism, IMP Tax calculated for import of goods art. 33a.

- In Proportion – parameter available on sales documents. It is used for classifying a given sale as taxed or tax-exempt, which allows for calculating a sale structure indicator for completing a purchase related with tax-exempt and taxed sale.

- Parameter value: Include, Exclude, In the denominator only

- Output tax correction on intra-Community purchase of fuels – parameter available on sales document for EU transaction type. It is used for classifying an invoice to the field of JPK_V7M file relating to intra-community acquisition of motor fuels

- Parameter values: Yes, No

[/alert] If pattern type is set to Obligatory in an account definition, it will not be possible to edit the VAT parameters. [/alert]

Vendor’s Tax Point – date according to which the vendor’s tax point will be determined. It is possible to select a tax point definition specified in the menu Configuration → Accounting →Tax Point. A date can be selected from the calendar manually only in case of option Any Date. This field is unavailable for databases created in French. In a VAT sales invoice, the corresponding field is called Tax Point

Right To Deduct – date according to which the right to deduct VAT tax will be determined. It is possible to select from among Tax Point Definitions available in tab Configuration → Accounting → Tax Point. A date can be selected from the calendar manually only in case of option Any Date. This field is unavailable in VAT sales invoices

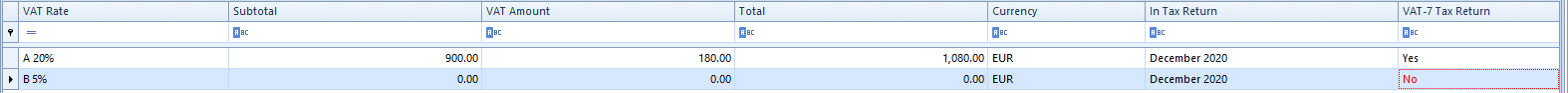

VAT Deductible Date – month and year of including a document in JPK_V7M file/VAT-7 tax return. This field is non-editable – it is specified on the basis of

- right to deduct date – in a VAT purchase invoice

- tax point date – in a VAT sales invoice

After completing the mandatory field, the invoice item must be added. It can be added:

- in table

- through form

Description – field for providing additional description of a document. This field is available in each tab of VAT invoice

Adding VAT invoice item in table

In order to add a VAT invoice item in table, click [Add] in the List button group. Then, a new line of VAT invoice item appears and it is divided into columns selected by a user; by default, these columns are: VAT Rate, Subtotal, VAT Amount, Total, Currency, VAT Deductible Date, V7M, VAT-EU Declaration (for transactions of intra-community type for on documents for received and released items), VAT Deductions, Type, Input Tax Correction. Individual fields must be filled in with appropriate values.

Additionally, on documents for received items, columns VAT%, Vendor’s Tax Point Date, Date of Deduction, Account, National/Intra-Community/Non-EU (depending on transaction type), Vendor’s Tax Point, Description, Right To Deduct, Account, VAT%. On documents for released items additional columns are: Account, VAT%, Tax Point Date, Tax Point, National/Intra-Community/Non-EU (depending on transaction type), Description, Account, In Proportion.

In databases created in French, column Account is only available on invoices and their corrections added in an account manually. It is thus not available on documents generated automatically from trade documents.

Adding an invoice item in table is a faster and more convenient method for entering of accounting data into the system. Thus, entered item need not to be saved. The entire document must be saved only.

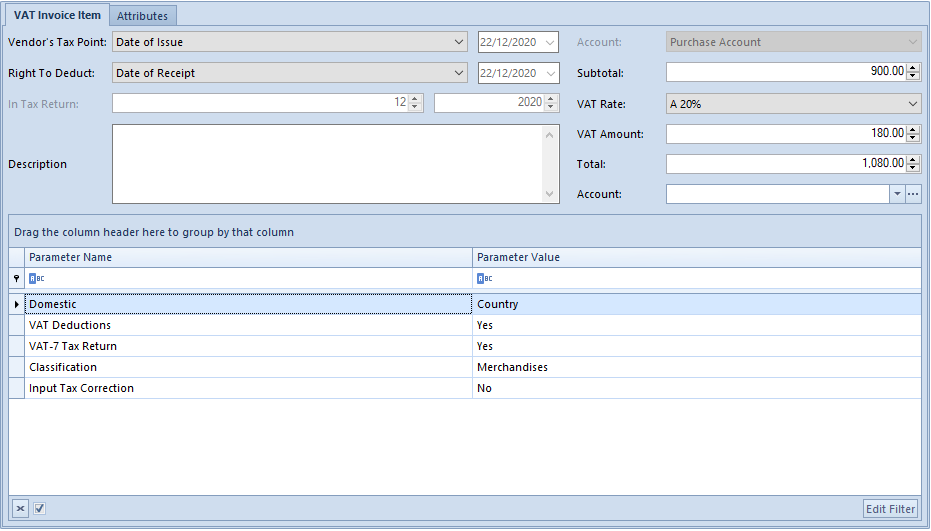

Adding VAT invoice item through form

In order to add a VAT invoice item through form, click [Add Through Form] in the List button group. Then, a form of VAT invoice item is displayed.

VAT Invoice Item tab

Vendor’s Tax Point – date according to which the vendor’s tax point will be determined. It is possible to select from among Tax Point Definitions available in tab Configuration → Accounting →Tax Point. A date can be selected from the calendar manually only in case of option Any Date. This field is unavailable for databases created in French. In a VAT sales invoice, the corresponding field is called Tax Point

Right To Deduct – date according to which the right to deduct VAT tax will be determined. It is possible to select from among Tax Point Definitions available in tab Configuration → Accounting → Tax Point. A date can be selected from the calendar manually only in case of option Any Date. This field is unavailable in VAT sales invoices

Account – by default, it is an account in which an invoice was registered. If the account contains subaccounts, it is possible to select appropriate subaccount

VAT Deductible Date – month and year of including an item in JPK_V7M file/VAT-7 declaration

Description – additional description of an item

Subtotal – item subtotal amount

VAT Rate – VAT rate included in VAT rate group assigned to a company to which a user is logged-in

VAT Amount – VAT amount

Total – item total amount

Account – allows for assigning an account to the item. In databases created in French, column Account is only available on invoices and their corrections added in an account manually. It is thus not available on documents generated automatically from trade documents

VAT Parameters – allows for assigning of values to individual VAT parameters

Attributes tab

This tab is described in article Attributes Tab.

Upon all the fields are filled in, save the item by clicking [Save].

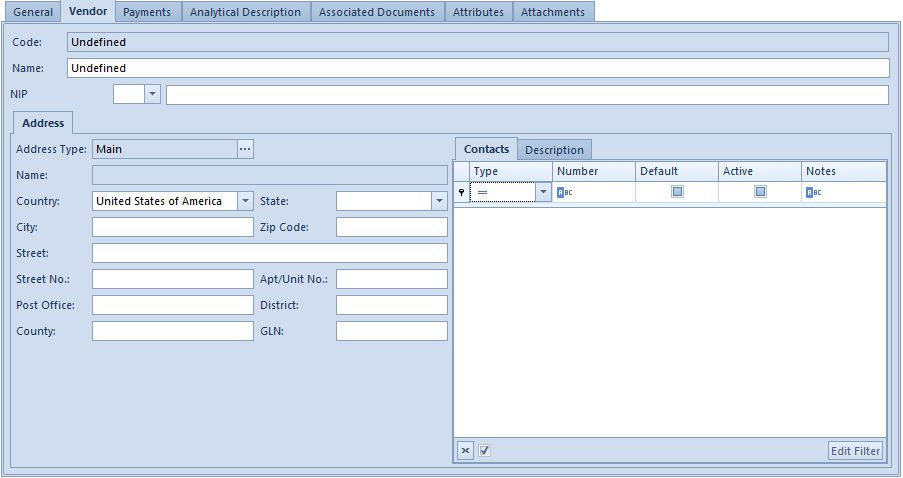

Customer/Vendor tab

This tab contains customer’s/vendor’s address details. This data is filled in automatically upon selecting the customer/vendor in tab General. Until a document is posted (if full diagram of statuses is disabled), all the information displayed in this tab can be modified or completed, if missing. By changing it, the data will be updated in the customer/vendor form.

If full diagram of statuses is enabled, it is possible to update customer/vendor address in a confirmed document by clicking on button [Change Address], whereas that user must have the permission to update data of a customer/vendor in confirmed documents assigned (Configuration → Company Structure → Operator Groups → tab Other Permissions).

Payments tab

- This tab is available only for documents added directly to a VAT account. It contains a list of payments assigned to a given invoice.

- From the level of customer and vendor payments (subtab Finances) it is possible to complete/compensate a document.

- If the invoice, being issued, is to be paid in several installments (e.g., part of it is paid in cash while issuing the document and the other part will be paid by bank transfer within 7 days period) – it is possible to divide the due payment.

- The list can be modified with the use of standard buttons available in the Payments button group.

Analytical Description tab

Description of this tab can be found in category Analytical Description.

Associated Documents tab

In case of invoices entered to VAT account manually, this tab remains empty.

In case of invoices with the source document in the form of a trade document, this tab contains a list of documents associated with the VAT invoice.

Attributes, Attachments, Chronology tabs

Description of these tabs can be found in articles Tab Attributes, Tab Attachments and History.

Saving a VAT invoice

Upon filling in all the fields, save the document by clicking [Save] in the VAT Invoice button group. The document will then appear on the list of VAT invoices.