Contents

General information

VAT accounts are used for registering documents subject to value added tax. On the basis of data contained in them, a tax return is generated. The number of kept VAT accounts depends on the specification and diversity of a business activity. The minimum structure of VAT accounts should contain one sales account and one purchase account for merchandises and services. In case of foreign transactions, it is possible to create an export account and an import account of merchandises and services. For example, an account for each type of purchase can be kept: purchase account of intangible assets, purchase account of fixed assets, purchase account of materials, purchase account of merchandises, purchase account of foreign services, import account of foreign services, and others.

The functionality of VAT accounts requires configuration of additional parameters available in system configuration window (System → Configuration → Accounting → Parameters) as well as configuration of the Accounting module.

System configuration

Within the system configuration, in System → Configuration → Accounting → General Parameters, there is parameter VAT accounts numeration which is related to VAT accounts. It determines how ordinal numbers are assigned to documents in VAT accounts (No.). There are two options available for selection: monthly or yearly. The value of the parameter can be changed at any moment during work with the system. Accounting module configuration

Within detailed configuration referring to the Accounting area, it is possible to define VAT parameters and define specification of Tax Point.

VAT parameters

Because Comarch ERP Standard is dedicated to international markets, it has been adjusted to observe tax regulations applied in a given country. Tax declarations differ considerably in each country in structure and requirements, therefore, the system allows the user to flexibly define and load VAT parameters, depending on the location.

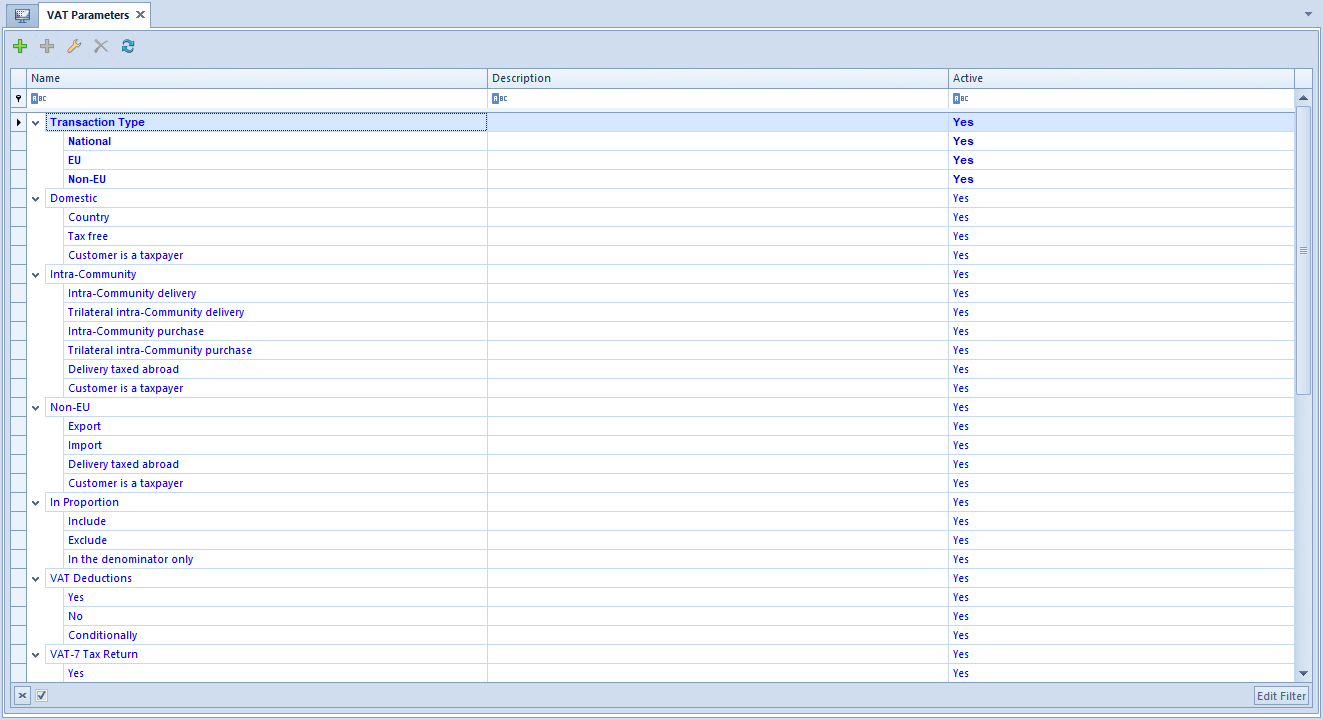

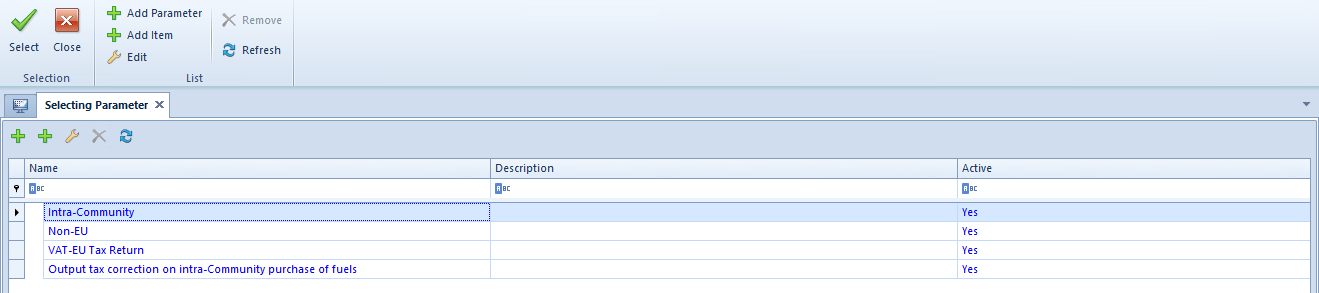

VAT parameters can be defined from the level of Configuration → Accounting → VAT Parameters. The defined VAT parameters are shared by all companies and their child centers.

VAT parameters can be selected on trade documents and when adding documents to VAT accounts.

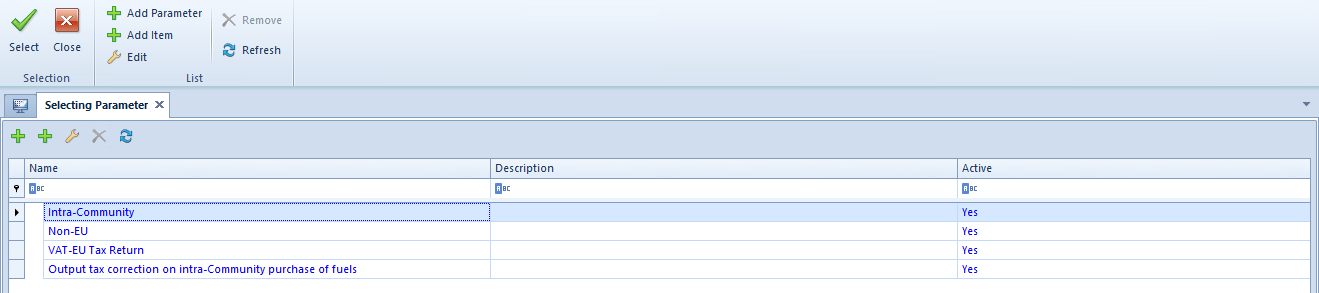

Parameters are divided in the system into three groups:

- Main parameters (marked on the figure below in blue bold font)

- Default parameters (marked on the figure below in blue font)

- User parameters (marked on the figure below in black font)

The main group and default group can be edited only in terms of activity status. In addition, it is possible to add subsequent parameters (default and user parameters) to the main group.

Defining VAT parameter

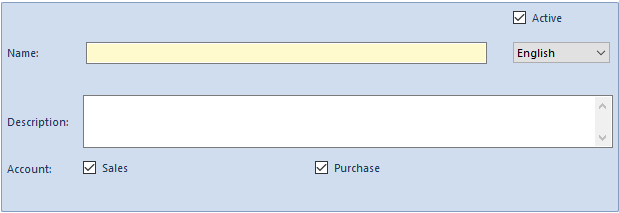

A new VAT parameter can be added by clicking [Add Parameter] in the List button group. A form with the following buttons is opened:

Name − field allowing for entering the name of a new parameter

Description − field allowing for entering the name a new parameter

Active − parameter checked by default when adding a new parameter. If unchecked, a given VAT parameter becomes archival, which means that it can no longer be used in the system, e.g., it is not possible to issue any documents related with it.

Account − two fields indicating the presence of a given parameter in sales/purchase VAT accounts.

To save changes, it is necessary to click [Save] button in the Actions button group.

To registered parameters, it is possible to add elements which are defined the same way as parameters. An element can be added after selecting a parameter it will be added to and then clicking [Add Item].

Such a defined parameter with elements assigned should then be added to one of the main parameters. To do so, on the edited form, select of one of the main parameter’s elements: National, Intra-community, or Non-EU, then click [Add] in the List gropu of buttons which will open a window with the list of available parameters. The selection of parameter must be confirmed by clicking [Select] in the Selection button group.

Such defined parameters are presented in definitions of accounts along with appropriate types of transactions and are available for selection in documents registered in a VAT account.

Tax point

The system allows for defining of any number of tax point definitions. Both Polish tax law (The Goods and Services Tax and Excise Duty Act) and international tax law specify many particular tax points for VAT, so a user can flexibly define their number.

Tax points defined by a user are shared by all the companies and their child centers.

The tax point is defined from the level of the tab Configuration → Accounting →Tax Point. In the system, there is a list of predefined definitions of tax point. A user may use these definitions as well as add his/her own.

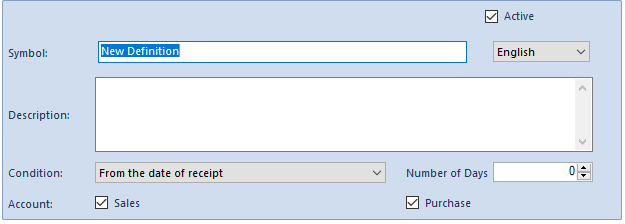

In order to add a new tax point definition, click on [Add] from the List button group. Then, a form of tax point opens.

Available fields:

Parameter Active − unchecking it deactivates definition

Symbol − tax point definition name

Description − additional description of definition

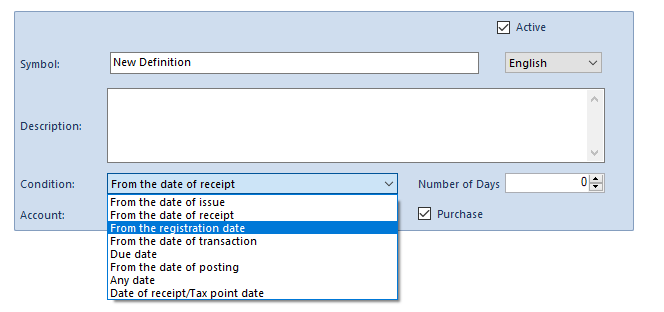

Condition – allows for selecting one of the available options on the basis of which a tax point date will be calculated in VAT invoice

Available options:

- From the date of issue

- From the date of receipt

- From the date of registration

- From the date of transaction

- Due date

- From the date of posting

- Any date

- Date of Receipt/Tax Point Date

- From receipt confirmation date (option available only in Polish system version)

- Date of Sale/Receipt Confirmation Date (option available only in Polish system version)

Number of Days − additional number of days from the date selected in the condition

Register − Sales or Purchase Checking this parameter by given type of account provides possibility of selecting a definition in corresponding VAT accounts and VAT invoices (of sales or purchase type).

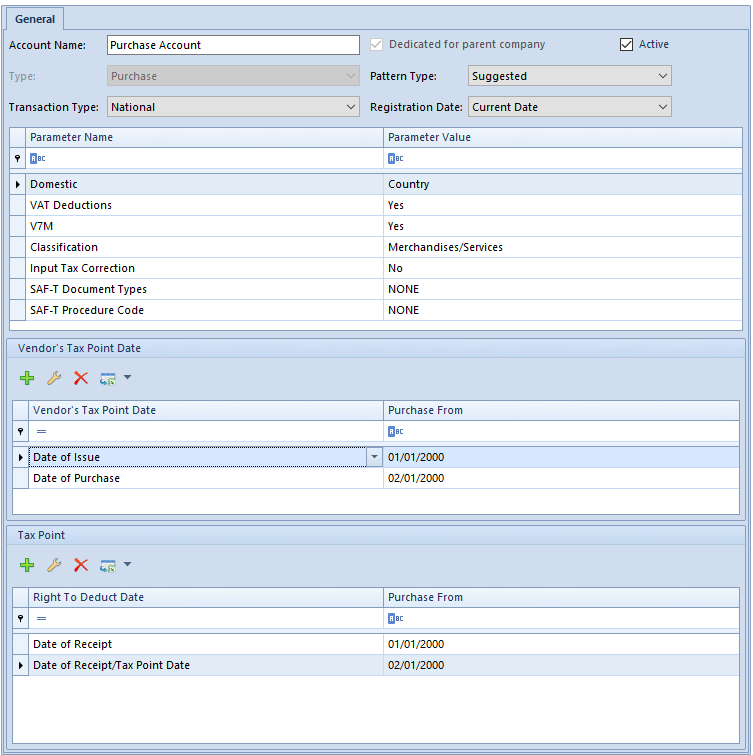

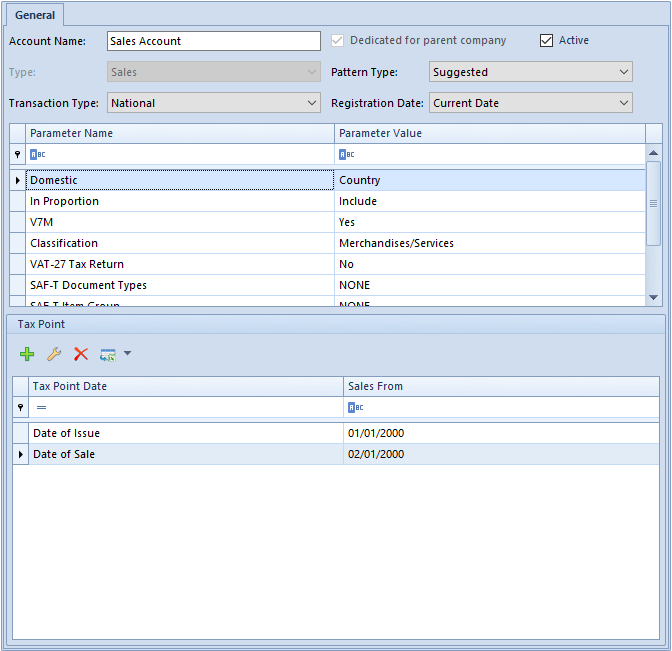

Tax point definitions defined in the system can later be used both in definitions of VAT accounts (Sales and Purchase) and on particular VAT invoices.

Examples referring to determining vendor’s tax point date and right to deduct date in a VAT purchase invoice as well as to determining tax point date in a VAT sales invoice are described in chapter Adding VAT account.

Generic directories

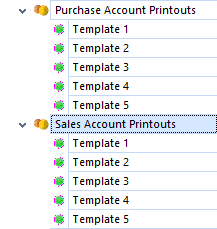

Within the list of predefined generic directories provided in the system, there are directories referring to printouts available from the level of VAT account (Configuration → Generic Directories):

- Sales Account Printouts group:

- Templates

- Purchase Account Printouts group:

- Templates

Templates are defined separately for sales account and purchase account printouts.

Owing to defining of appropriate templates, a user can select which VAT rates are included in printouts available from VAT account level. Before generating printouts in VAT accounts, a user may choose which of the defined templates should be used in a given printout. Layout of the printout is adjusted to the selected template. The data and order of printing rates are consistent with settings specified in the template.

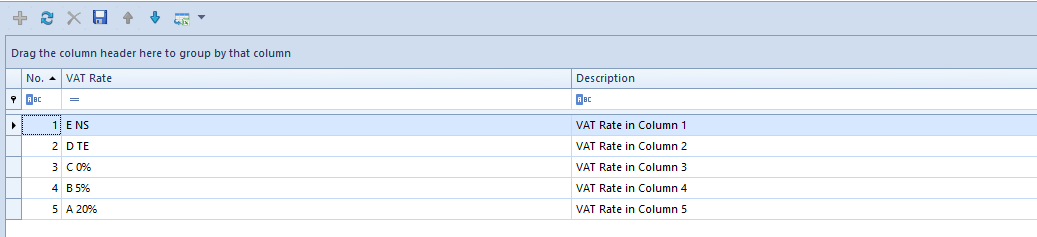

Within each printout group, there are 5 predefined templates which cannot be deleted. It is neither possible to add new ones. In each template, it is possible to define 5 elements at most, within which VAT rates are defined, referring to a given column displayed on a printout. The list of VAT rates is retrieved from the system configuration. Apart from VAT rates from the configuration, a user may also select value <none> − then, a given column is presented as empty in the printout and its total value is displayed as: 0% TE NS.

In each of the predefined group in the generic directories, the first template on the list is defined. It has values as shown in the figure below, which can be modified.