Due to specific nature of enterprise operation, users usually introduce divisions within VAT purchase and sales accounts. It may happen that users register documents in improper VAT accounts by mistake. Such situation refers not only to a single document, but to the whole group of documents.

A VAT account can be changed directly in a specific document or in a form of batch change of VAT account, which allows for changing of VAT account in a single invoice or a batch change in selected group of documents. Analogical situation applies to tax point date change. In this case, it is possible to change date of tax point in selected VAT invoices collectively, so that the user does not have to change the date on every single document.

In the system, it is also possible to change VAT parameters and tax point date in VAT invoice which is already posted and in invoices generated from trade documents. Invoices are often posted and only then VAT parameters are updated and tax point date is specified.

Both batch changes in VAT accounts and changes in posted VAT invoices can be performed after appropriate permissions are granted to the operator. These permissions are described in detail in article Permissions concerning VAT accounts.

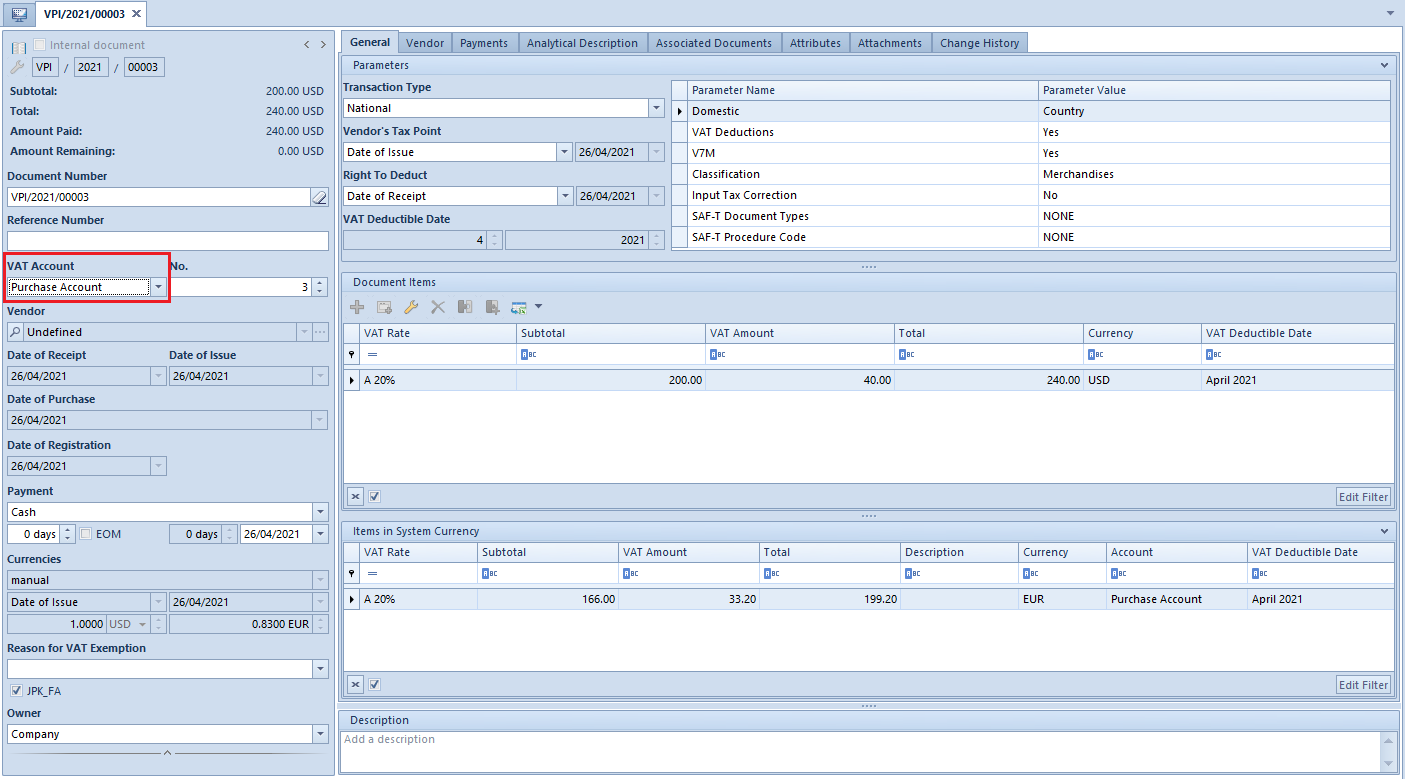

Change of VAT account on a single document

In order to change VAT account on a confirmed/posted VAT invoice, the invoice must be reedited and new VAT account, in which the document will be registered, must be selected in the field Account.

Upon selecting the account, the system asks the user which parameters regarding the account should be changed. In a new window it is possible to select them. If none option is checked, then VAT parameters are not changed during change of the account. In this case, the change applies only to the account/subaccount. If any of the options is checked, then only the selected data is updated in a document, on the basis of VAT account/subaccount pattern definition

In case of accounts of Suggested type, the use can select which parameters should be changed. Such option is unavailable for accounts of Obligatory type. When changing account to obligatory account, all options are checked and greyed out. In such case the document inherits all settings from the account definition.

The system operates the same way in case of changing account to an obligatory account, when all the options are automatically checked.

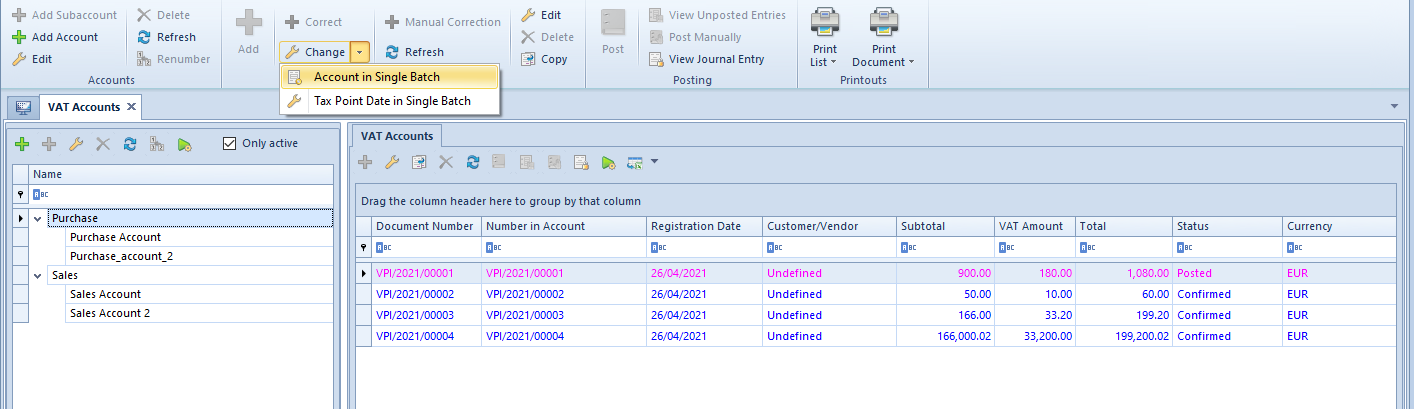

Change of VAT account in a single batch

In order to change VAT account in a single batch, mark VAT invoices on the list and then select [Change] → Account in Single Batch in the List button group.

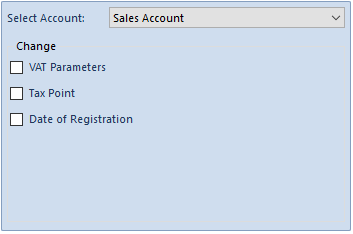

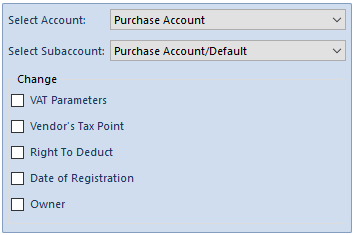

Then, a window with VAT accounts opens, in which the user selects account to which the marked documents must be transferred and checks which VAT parameters should be changed

If a company introduced additional division of accounts into subaccounts, it is also possible to change the subaccount. In such case, an additional section with list of subaccounts appears in the window

Upon clicking [Confirm], the system makes changes in parameters selected by the user.

In case of accounts of Suggested type, the use can select which parameters should be changed. Such option is unavailable for accounts of Obligatory type. When changing account to obligatory account, all options are checked and greyed out. In such case the document inherits all settings from the account definition.

The system operates the same way in case of changing account to an obligatory account, when all the options are automatically checked.