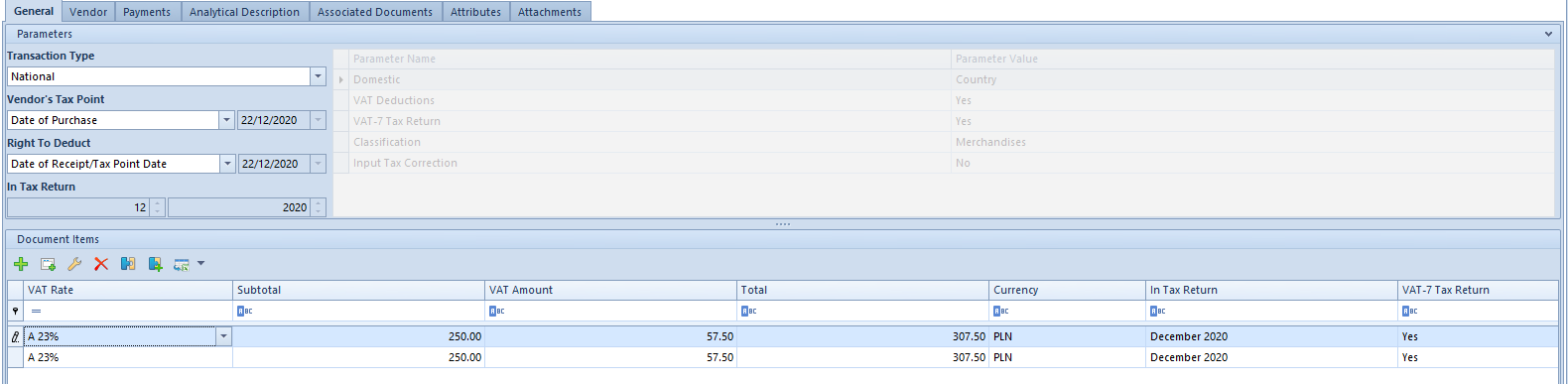

According to regulations concerning value added tax, in some cases an entrepreneur running business activity is entitled to deduct the input tax amount from the output tax only up to the value determined by appropriate amount or percentage limit. Because of that, in Polish language version of the system, it is possible to control VAT deduction limit.

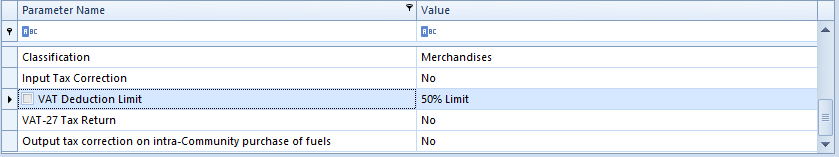

A user may select predefined value of deduction limit, that is 50 % Limit, or define own percentage and amount limits, which can be later selected in item of a VAT purchase invoice and its corrections.

Amount and percentage limit can both be specified in a limit definition added by a user. If in VAT deduction limit there is percentage as well as amount value specified, the system calculates value of the limit on the basis of percentage limitation, compares it with value of the amount limit and selects the smaller of the compared values.

It is impossible to edit the parameter on a posted or confirmed (if full diagram of statuses is enabled) document, regardless of operator permissions to change parameters in a confirmed/posted VAT invoice.

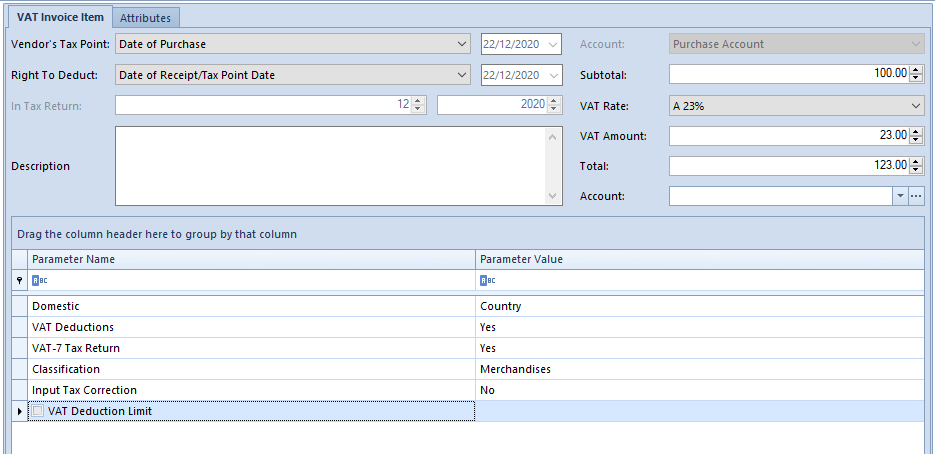

When saving an item with VAT Deduction Limit parameter, control of VAT amount value with selected VAT deduction limit value is performed. If the value is exceeded, the system automatically updates VAT amount to amount of the selected limit and generates a difference item

with parameter VAT Deductions set to No.

It is possible to divide VAT amount of a VAT purchase invoice item or its correction with the use of button [Divide VAT] provided that the parameter VAT Deduction Limit has first been selected and the parameter VAT Deductions has been set to Yes. As a result, the system performs the same operation as in case of checking parameter VAT Deduction Limit in a document item.

VAT amount not subject to deduction will be included in analytical description of a document.

On the list of VAT accounts, it is possible to filter documents with VAT deduction limit by checking parameter VAT Deduction Limit in the filter panel. A user may decide whether all documents with VAT deduction limit will be displayed or only those with specific value of the limit, e.g., 50 %.